tax avoidance vs tax evasion uk

It is estimated that in 201920 the financial loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion. The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the law.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

HM Treasury HM Revenue Customs The Rt Hon Danny Alexander.

. As such tax evasion comes with a heftier penalty than tax fraud. Fraudsters who carried out a 100 million tax avoidance fraud have been sentenced to 27 years in prison. In recent years concerns as to the scale of mass marketed tax avoidance schemes have led to three major initiatives to undermine this market and encourage a sea change in attitudes.

In this respect tax evasion may be more of the low-hanging fruit given its frequency and many different forms. Tax planning either reduces it or does not increase your tax risk. The difference between tax avoidance and tax evasion essentially comes down to legality.

On 16 Feb 2022. In the UK income tax evasion may result in a maximum penalty of seven years in jail or an unlimited fine. This document sets out the action taken this Parliament to tackle evasion and avoidance.

Other ways to report. Lord Templemans article in a 2001 Law Quarterly Review called Tax and the Taxpayer identified 3 approaches used to reduce tax burdens. You may also be on the hook for the.

So above I started off talking about Tax Evasion vs Tax Avoidance. Contact the HMRC fraud hotline if you cannot use the online service. What is tax avoidance and what is tax evasion.

The difference between tax evasion and tax avoidance largely boils down to two elements. At the courts discretion a Magistrate may impose a penalty of up to 6 months in jail or a maximum fine of. HM Revenue and Customs said the.

Unlike tax avoidance tax planning is the practice of minimising tax liability with no intention of deceit. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. The Disclosure of Tax.

The amount of tax lost in Britain through non-payment avoidance and fraud has increased to 35bn according to official figures. Crossing that line can lead to hefty fines and prosecution. We have gathered examples from recent and historic high-profile cases to help you unpick the fine line.

Avoiding tax is legal but it is easy for the former to become the latter. Tax avoidance is structuring your affairs so that you pay the least amount of tax due. HMRCs work on the tax gap is collated on Govuk 3 HMRC press notice Tax gap remains.

If you are convicted of tax evasion there can be a very large six-figure fine and a potential prison term of up to five years. In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B consists of two reports one. On the other hand tax evasion involves deliberately.

2 The tax gap 3 The Coalition Governments approach. The first method is tax evasion and is a criminal offence. Genuine mistakes on a tax return such as misculautions and missed deadlines can also be considered tax avoidance.

Tax avoidance and tax evasion Summary 1 Introduction. Some practices of tax avoidance have been found to have the. 44 203 080 0871.

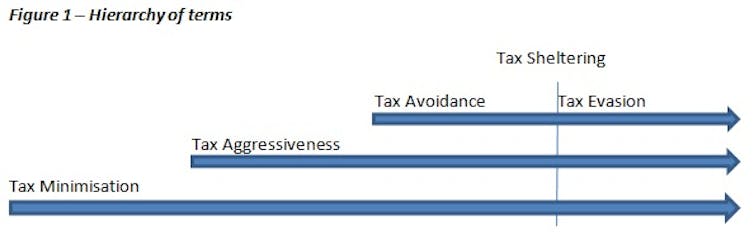

Some luminaries have 3 categories instead of 2. Tackling tax evasion and avoidance.

What Are Tax Evasion And Tax Avoidance Taxes 101 Easy Peasy Finance For Kids And Beginners Youtube

Hmrc Lost 5 5bn In Tax Evasion Black Hole Over Pre Pandemic Year

Tax Avoidance Vs Tax Evasion Understand The Difference Youtube

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Explainer The Difference Between Tax Avoidance And Evasion

Boundaries Of Aggressive Tax Planning Behaviour Retrieved From 19 Download Scientific Diagram

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion Infographic Fincor

102 Tax Avoidance Illustrations Clip Art Istock

Estimating International Tax Evasion By Individuals

Budget Summary 2021 Key Points You Need To Know

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Tax Evasion Tax Avoidance Definitions Differences Nerdwallet